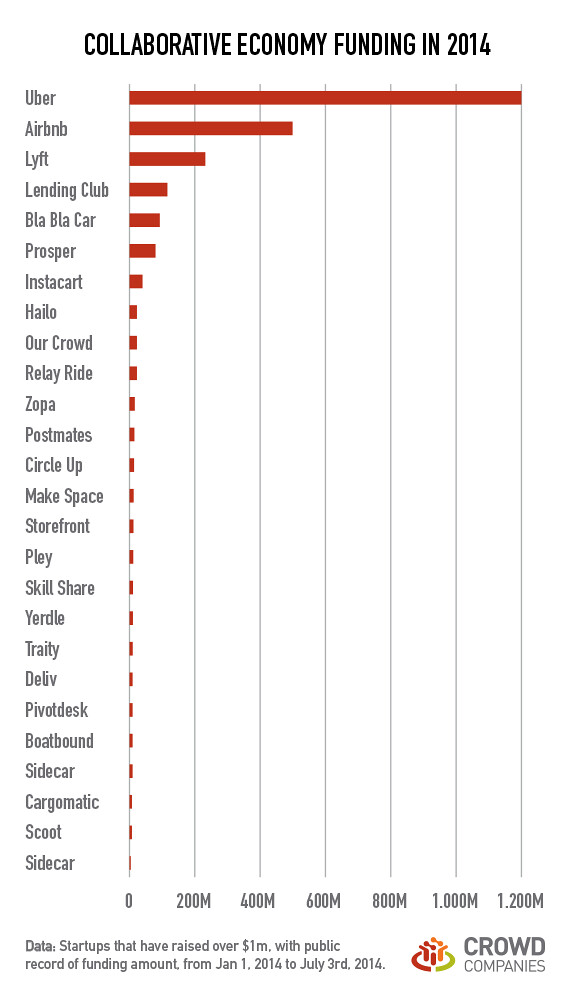

[2014 funding has increased 350% in deal size mainly due to large investments in Uber, Airbnb, Lyft, Lending Club, and BlaBlaCar]

Exactly one year ago, the average funding amount was $29m. In July 2013, I surveyed a sample of 200 startups (read full report). I found that 37% had been funded, with startups receiving an average of $29 million in funding. The 200 had received over $2 billion in total funding, which is a very high amount for a largely undeveloped, pioneer market. Interviews with several of the Venture Capitalists in this space indicated that they favor two-sided marketplaces that are scalable and have low inventory costs

[In 2013, average funding was $29 million. In 2014, the average funding amount is $102 million due to outliers, like Uber, receiving over $1.2 billion]

In the first half of 2014, the average funding amount, is a whopping $102 million. The findings are stunning. I’ve not seen this much investment in tech startups for some time. Some data highlights: In seven short months, there’s been at least 24 distinct funding instances of at least $1 million or more in investment funding. Of those, Uber received the lion’s share of a whopping $1.2 billion in investment for global growth and product expansion. On average, $102 million is the common amount, but if you strip off the Uber investment, Airbnb, Lyft, and Lending Club are lower in investment amount, bringing the average closer to $52 million, which is still very high.

Last Seven Months of Collaborative Economy Funding by Date

You can access the Google sheet with this data by date, industry, and size. Please note the numbers are shifting as new data is being added.

| Date and Source | Startup | Amount |

| 1/10/2014 | Sidecar | $1,000,000 |

| 1/20/2014 | Hailo | $26,500,000 |

| 1/29/2014 | Zopa | $22,700,000 |

| 1/30/2014 | Scoot | $2,300,000 |

| 2/18/2014 | Postmates | $16,000,000 |

| 2/24/2014 | Deliv | $4,500,000 |

| 2/28/2014 | SkillShare | $6,100,000 |

| 3/20/2014 | Pley | $6,800,000 |

| 3/26/2014 | CircleUp | $14,000,000 |

| 4/2/2014 | Lyft | $250,000,000 |

| 4/8/2014 | Airbnb | $500,000,000 |

| 4/10/2014 | Pivotdesk | $3,600,000 |

| 4/14/2014 | Storefront | $7,300,000 |

| 4/26/2014 | Yerdle | $5,000,000 |

| 4/28/2014 | OurCrowd | $25,000,000 |

| 4/29/2014 | LendingClub | $115,000,000 |

| 4/30/2014 | MakeSpace | $8,000,000 |

| 5/4/0140 | Prosper | $70,000,000 |

| 6/4/2014 | Sidecar | $3,100,000 |

| 6/6/2014 | Uber | $1,200,000,000 |

| 6/16/2014 | Instacart | $44,000,000 |

| 6/24/2014 | Cargomatic | $2,600,000 |

| 6/24/2014 | RelayRide | $25,000,000 |

| 7/1/2014 | BlaBlaCar | $100,000,000 |

| 7/3/2014 | Traity | $4,700,000 |

Last Seven Months of Collaborative Economy Funding by Amount

Above image is the same data.

| Uber | $1,200,000,000 |

| Airbnb | $500,000,000 |

| Lyft | $250,000,000 |

| LendingClub | $115,000,000 |

| BlaBlaCar | $100,000,000 |

| Prosper | $70,000,000 |

| Instacart | $44,000,000 |

| Hailo | $26,500,000 |

| OurCrowd | $25,000,000 |

| RelayRide | $25,000,000 |

| Zopa | $22,700,000 |

| Postmates | $16,000,000 |

| CircleUp | $14,000,000 |

| MakeSpace | $8,000,000 |

| Storefront | $7,300,000 |

| Pley | $6,800,000 |

| SkillShare | $6,100,000 |

| Yerdle | $5,000,000 |

| Traity | $4,700,000 |

| Deliv | $4,500,000 |

| Pivotdesk | $3,600,000 |

| Sidecar | $3,100,000 |

| Cargomatic | $2,600,000 |

| Scoot | $2,300,000 |

| Sidecar | $1,000,000 |

Data Summary

- Total investments from in last seven months: 24

- Average deals per month in 2014: 3.4

- Average funding amount in June 2013 study: $29 million

- Average funding amount in last Jan-July 3, 2014: $102.6 million

- Median funding in last seven months: $14 million

- Average Funding Amount (excluding Uber) in last seven months: $52.6 million

- Total Amount of Funding in last seven months: $2.46 billion

- Increase in funding amount per investment in 12 months: 351%

Conclusion: Investors love the Collaborative Economy But will it bust?

So, why are investors betting big on the Collaborative Economy? These scalable business models run on top of highly adopted social and mobile technologies. They offer a high frequency of transactions, with low operating costs. They are also disrupting traditional corporate business models, as they are more efficient by leveraging internet of everything, mobile devices, apps, and payment platforms. Neal Gorenflo reminded me that these startups cause the incumbents to wail in the media, creating incredible low cost PR value, which in turn attracts more customers.

In summary: Investors expect these startups to be highly profitable and are betting down big.

There is something at odds here where a small group of VC’s end up profiting massively from the monetisation of what was in the past a pretty simple act: “Can I borrow your car?’ “Can you lend me a hammer?”. It also flies in the face of the foundation of the peer-to-peer economy, no? People trading with people – a spare couch for some spare change but in the background there’s the very familiar site of Big Corp ruling supreme and waiting to make off like bandits due to the trust between consumers.

And then there will be the required Exits – IPO? If Airbnb is acquired by Hilton (ha ha) does that kill the magic?

The ultimate collaborative business would surely be crowd funded by the people for the people – but hard to see getting heavy, heavy money in through that channel. Mmmm…going around in circles here. Amazing data though. Thank you!

Jason

This tension (p2p startups funded by capitalists) is one that was highly discussed –and debated– at the SHARE conference.

Oh interesting. I might check out their site. So curious to see how it shakes outs.

SF Gate covered the story, by Carolyn Said. Quotes by Janelle Orsi are relevant to your assertion:

http://www.sfgate.com/technology/article/S-F-conference-brings-sharing-economy-into-5475596.php

Terrific – thanks.

Is there a resource listing other share economy gatherings in the US and beyond? Any other affiliations you recommend. My company is not quite the size to join your group.

I’d follow Shareable http://shareable.net and Chelsea Rustrum, https://twitter.com/chelsearustrum and Lisa Gansky (https://twitter.com/instigating and https://twitter.com/ouishare to find out about their events.

You’re a champ. Thanks.