As part of my ongoing research as an Industry Analyst on the Collaborative Economy (read all the posts), I have talked about market drivers, the market challenges, corporations who have jumped in, provided a list of startups, and published a definitive report called The Collaborative Economy. I will now help you to better understand the funding aspect of this growing movement. We obtained a list of 200 startups (appropriately using a Taskrabbit, I might add) in order to get our initial sample. I recently published an infographic helping to reveal the patterns in this sample. Now I want to expose some additional data about the force that funds this space.

Key Findings from the Collaborative Economy Funding:

- Heavy Funding Has Spurred this Market Forward. Across the 200 startups, I have found that 37% had been funded, with startups receiving an average of $29 million in funding. The 200 had received over $2 billion in total funding, which is a very high amount for a largely undeveloped, pioneer market. Interviews with several of the Venture Capitalists in this space indicated that they favor two-sided marketplaces which scale and have low inventory costs. They are basically transaction machines akin to eBay or Netflix.

- A Few Startups Received Exceptionally Large Funding Amounts. Not all startups are equal. Some have received far more funding than others. These giants include players like AirBnb which received about $120 million; Lyft, which recently raised around $60 million; and Uber, securing over $57 million. Most startups have not yet obtained such large funding amounts, although, as this market heats up, it will find additional funding opportunities.

- SV Angel and Benchmark Funded Most Frequently. San Francisco and Silicon Valley-based firms funded these firms most frequently, which coincides with the high concentration of Collaborative Economy startups in the SOMA district of the city. In particular, SV Angel and Benchmark were the highest frequency funders, followed by Incubator/Accelerator 500 startups Andressen and Floodgate, which are located in the Silicon Valley and San Francisco area.

- Market Has Received Early Stage Funding. Of the total funding of the nearly 80 startups, most are in an early stage, with the most dominant being Seed round, followed by ‘A’ round. The other category includes non-disclosed personal loans, bootstrapped self loans, and the ambiguously termed ‘Venture Round,’ which could be construed to mean a variety of things. This early market funding, which started to emerge about 3 years ago, matches the funding levels being shown.

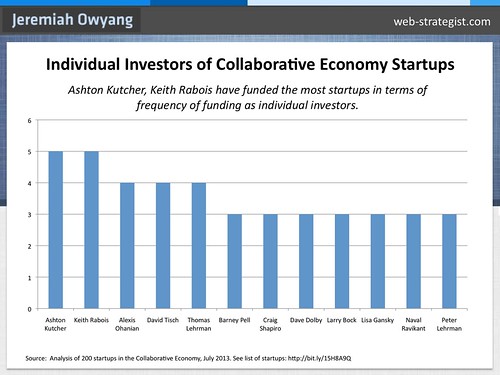

- Individual Investors Include Hollywood Stars and Internet Veterans. Early stage funding often includes celebrity investors who want to get in on the action, angel investors, and a “friends and family” round of other successful entrepreneurs. Ashton Kutcher has invested in 5 startups in this market, and seasoned internet exec, Keith Rabois, is reported to have individual investments in many startups in this market. We should assume there are other personal loans and investments made that were not apparent in our public searches.

Graphics: Key Investors in the Collaborative Economy:

After segmenting the data, we comprised these graphs, based off frequency patterns per startup.

Above: Individual investors are based off an updated sample size in Feb 2013, while data is accurate, it did not include new startups that were added to this market.

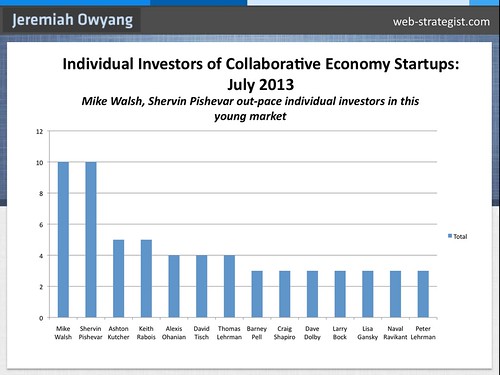

Above, On July 14th, I’ve added the following graph, which includes new investors not in the original sample size, collected in Feb. In all cases these graphs are correct, but they represent different sample sizes. New investors include Mike Walsh and Shervin Pishevar, who take the lead, in terms of frequency.

Methodology and Data Notations

See the full data sample was from 200 startups in the Collaborative Economy. Read the infographic to obtain a summary. Special thanks to the Collaborative Consumption crew, as many of the names were obtained from their site. Of the 37% who’d been funded, we mined public records ranging from Crunchbase, startup website, investor website, Wikipedia, news sources, and press releases to obtain data. We don’t believe this list is complete, but it is a representative sample of funding from easily obtained public sources.

We included the term “venture round” is an ambiguous term which can be used in a variety of ways, in the ‘other’ category, as it’s used both in early stage and later stage funding rounds. Obtaining the exact amount of how much each firm or individual invested is next to impossible, so obtaining frequency, and estimating per round helps to determine a relatively reliable figure. Compounding this complexity, multiple investors are often involved in each round, making specific dollar amounts even more difficult to determine. This information should not be used for official financial advice or guidance, but only for entertainment purposes only.

If you liked this post, see all my coverage and data on the VC market. Photos used under Creative Commons, by Philip Taylor.

Great information and I think these will be

really informative for me.

Great info Jeremiah! Thank you very much for share it with us.

My name is Facundo and I am one of the founder of Coomuna. We are launching soon a collaborative consumption community in Latinamerica.

We keep in touch!

Best,

Facundo

facundo@coomuna.com

Great insights Jeremiah. Here’s an infographic I put together illustrating positioning of sharing economy players: Social Currency v Social Connection

Yours sharely 🙂 John Sullivan, Founder, Sharely (see http://www.Sharely.Us )